Take Control of Your Credit Story

Unlock new credit opportunities with your free Credeed profile

Take Control of Your Credit Story

Unlock new credit opportunities with your free Credeed profile

Latest Update

Fast & Robust KYCs: The Key to Increasing Deal Velocity in Commodities Trading

In commodities trading, timing is everything. Deals move at breakneck speed, markets shift in real time, and counterparties expect transactions to be executed without delays. Yet, there’s one critical process that often slows things down: KYC (Know Your Customer) compliance.

Why Faster KYC Reports Are a Game-Changer for Commodities Traders

In the fast-paced world of commodities trading, every second counts. Whether trading oil, metals, or agricultural products, the ability to move quickly can mean the difference between securing a lucrative deal or missing out. One critical factor that can accelerate—or delay—transactions is Know Your Customer (KYC) verification.

AI in Financial Spreading: Transforming Direct Lending Operations

Direct lending institutions face a critical bottleneck that constrains growth and profitability: financial spreading. This process—standardizing borrower financials for credit analysis—consumes disproportionate resources while creating delays in loan processing. For mid-sized lenders processing over 2,000 financial documents annually, traditional approaches require teams of analysts to manually review and enter data from diverse document formats, resulting in extended turnaround times, elevated costs, and inconsistent data quality.

How it Works?

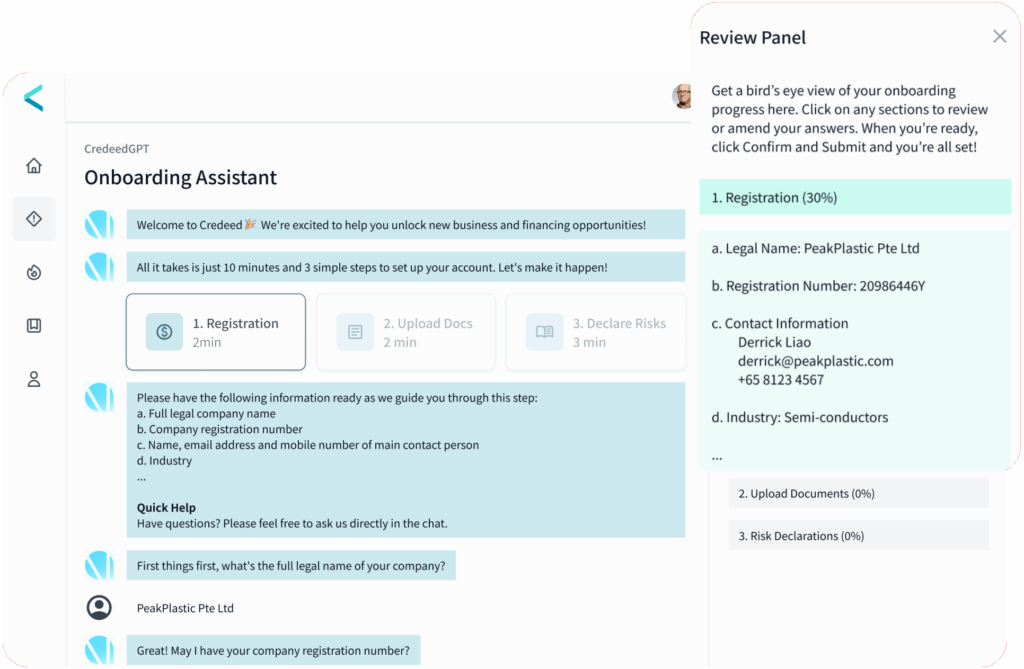

Create Free Credeed Profile in 10 Minutes

Answer some basic questions and upload your financial statements to create your very own Credeed Profile for free.

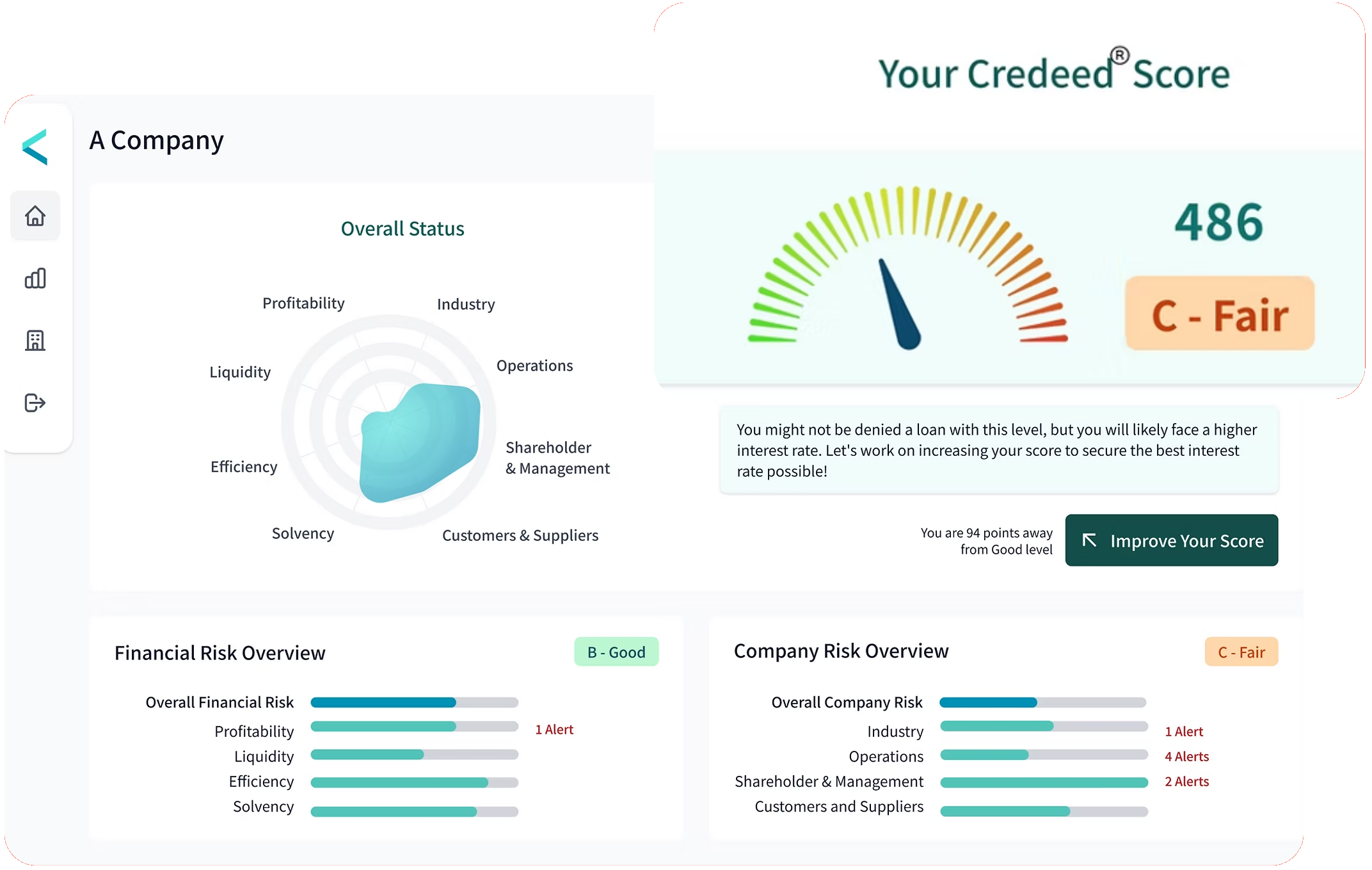

Monitor and Improve Your Score

Update your info, track your company’s progress and get real-time recommendations on how to improve and present your credit story.

Connect with Lenders

With a well-structured profile, you can qualify for better credit products with better terms and amounts. We will automatically help you find the loans based on your Credeed Score™.

Let Credeed Help You

Free Financial

Health Check

Loans and Credit

Consultant

Lifelong Financial

Advisor

Features That Work For You

For years, SMEs have struggled with opaque financial assessments and limited access to capital. Traditional methods often leave businesses in the dark about their true financial health and potential.

But now, the future of SME finance is clear, actionable insights, powered by AI.

Know Before You Go

Stay in control. Our system evaluates your risks and highlights any red flags, so you’re well-prepared to start a meaningful conversation with lenders before you apply.

AI Assistants

Make your voice heard. Use AI-driven insights to present your business in the best light and show lenders how you’re improving profitability and efficiency.

The Credeed Score™

Get the full picture. The Credeed Score™ gives you a clear, graded snapshot of your business’s health, giving you more control of the engagement with others.

Simple

Dashboards

Start the dialogue. Our easy-to-use dashboards let you present key metrics like revenue and profits, transforming data into a compelling story that lenders will engage with.

Get Your Free Financial Health Report Here

Let us help you supercharge your business success.