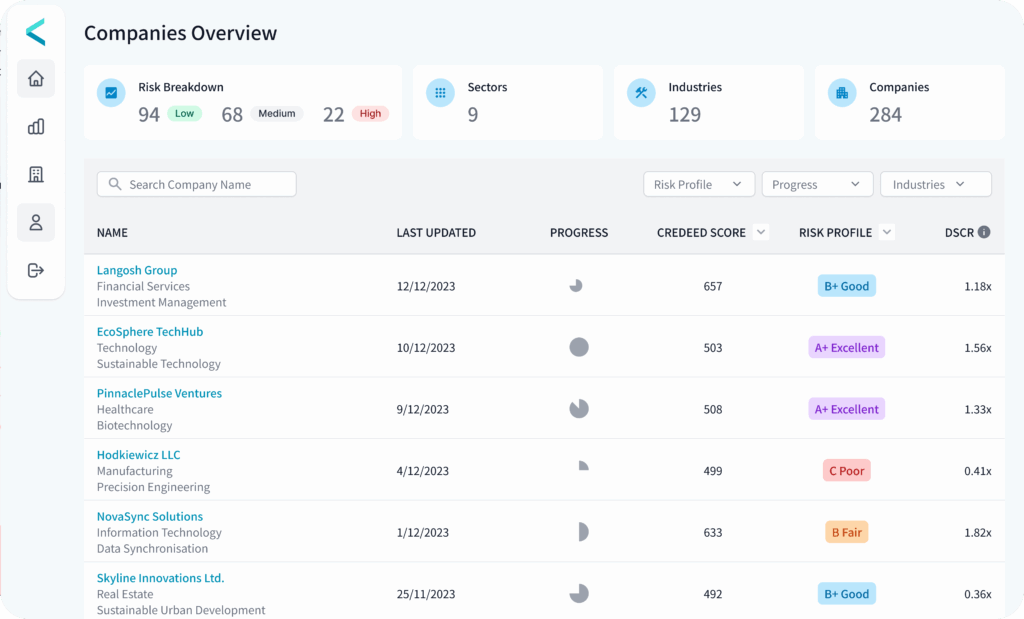

Credeed Score™

Introducing the Credeed Score™—our proprietary credit readiness methodology designed to streamline SME risk assessment. Based on international and industry benchmarks, combined with real-time data, the Credeed Score™ provides a simple, quick and credible evaluation for SMEs. The higher your Credeed Score, the more likely you can secure credit approvals.

How We Screen For Credit Readiness

Designed by seasoned bankers, credit experts and experienced SME financiers

Identity Verification

Standard identity verification by cross-referencing company registration details, addresses, business activities, subsidiaries, and affiliated entities with official sources.

Financial Risks

Evaluate an SME's financial risks by analyzing its profitability, liquidity, solvency, and efficiency indicators to identify both strengths and weaknesses.

Company Risk

Dive deeper into a company's industry, operations, shareholders & management, and customers & suppliers to assess business soundness.

External Risk

Continuously scan for external risk signals, including adverse media, sanctions, litigation, and country risks, providing real-time monitoring to ensure ongoing risk management.

Data Completeness

Ensure SMEs have the necessary documentation and information in place—an often overlooked but crucial step for successful applications and due diligence.

Frequently Asked Questions

Can I improve my Credeed Score?

Yes, you can improve your Credeed Score by addressing areas highlighted in the assessment. This may include enhancing financial performance, stabilizing business operations, or ensuring that all required documents and data points are complete and up-to-date.

How frequently is the Credeed Score updated?

It is updated whenever there is new information available.

With a Credeed Score, would I still have to go through internal credit assessments by lenders?

While internal credit assessments may still be required, Credeed ensures you’re fully prepared and helps streamline the process, making it smoother and more efficient.

What risk factors and indicators are considered?

The Credeed Score assesses three key areas: Financial Health, Business Stability, and Data Readiness. It includes over 40 metrics across financial performance, operational stability, economic conditions, and the completeness of relevant data and documents. Additionally, any concerns related to identity verification or external risks are highlighted.

How does the Credeed Score benefit me?

The Credeed Score offers a standardized and transparent assessment of an SME’s credit readiness from the outset. It simplifies the loan origination and qualification process, enabling you to focus on the opportunities that align best with your portfolio.

What makes the Credeed Score different from other credit scoring models?

Unlike traditional models that focus on default risk, the Credeed Score offers a clear, comprehensive view of an SME’s credit readiness. With transparent insights, it helps lenders quickly spot the best-fit opportunities for their portfolio.

Talk to Us Today

Let us help you supercharge your business success.